Pdd Stock 5 Year Forecast

Revenues from public cloud services rose 28.7% y/y to $261.7 million, and enterprise cloud services increased 77.7% y/y to $112.8 million. Pinduoduo annual revenue for 2020 was $9.118b , a 110.59% increase from 2019.

It is possible to fall more than 79% and also possible to fall less than 50%.

Pdd stock 5 year forecast. Broad market will support pdd advance at. Monthly and daily opening, closing, maximum and minimum stock price outlook with smart technical analysis Earnings growth (this year) +86.51%:

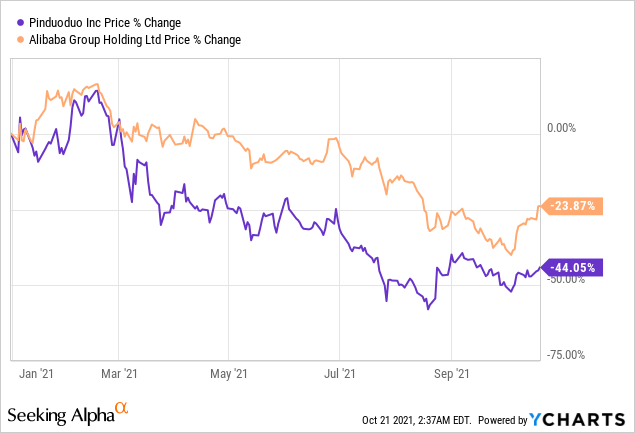

Pdd has fallen more than 62% and less than 79% so price is in the average fall zone. Pdd), china’s largest agriculture platform, pledged to. Revenue growth (last year) +97.59%:

Pdd industry sector(s) s&p 500; By zacks equity research november 3, 2021. The company’s revenue is forecast to grow by 80.50% over what it did in 2021.

Stock forecast as of 2021 december 01, wednesday current price of pdd stock is 71.960$ and our data indicates that the asset price has been in a downtrend for the past 1 year (or since its inception). According to the issued ratings of 10 analysts in the last year, the consensus rating for pinduoduo stock is buy based on the current 3 hold ratings and 7 buy ratings for pdd. Wall street will be looking for positivity from pdd as it approaches its next earnings report date.

Average monthly active users rose. 5 upward and no downward comments were posted in the last 7 days. Your current $100 investment may be up to $239 in 2026.

19, 2021 at 10:47 a.m. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and investment tools. Former parabolic arc with earnings tomorrow before market opens.

1298.544 * about the pinduoduo, inc. Number of shares sold short was 23.5 million shares which calculate 2.85 days to. A company’s earnings reviews provide a brief indication of a stock’s direction in the short term, where in the case of pinduoduo inc.

Earnings growth (next 5 years) +0.47%: Pdd is unprofitable, and losses have increased over the past 5 years at a rate of 7.9% per year. Sponsored adr (pdd) closed at $92.39 in the latest trading session, marking a +0.12% move from the prior day.

(pdd) raised $1.5 billion in an initial public offering on thursday, july 26th 2018. Pinduoduo annual revenue for 2019 was $4.33b , a 126.89% increase from 2018. The latest earnings per stock, revenues and financial reports for pinduoduo (pdd).

Arcs fall between 50 to 79% as a rule with the average falling between 62 and 79%. Price can remain volatile for some.

Post a Comment for "Pdd Stock 5 Year Forecast"