Iron Source Stock Forecast

Analysts tracking the stock expect greenpower sales to more than triple to $41 million in fiscal 2022 and grow by another 209% to $126 million in fiscal 2023. Their forecasts range from $37.50 to $42.00.

Lysyk reached that conclusion by comparing the corporation’s inventory forecasts made between january and june 2021 with actual demand.

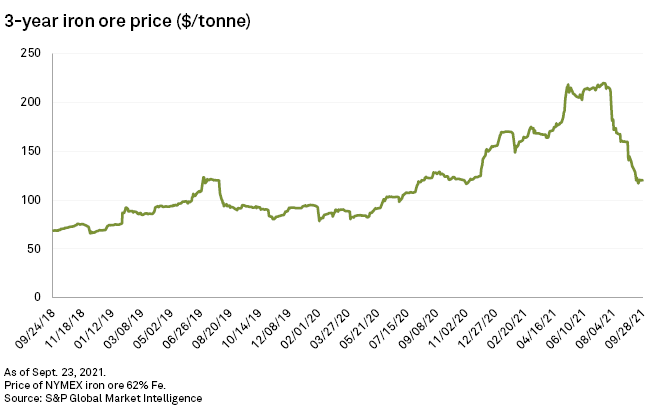

Iron source stock forecast. It had expected iron ore prices to drop to us$170/t in the fourth quarter before striking us$100/t in 2022. In the longer term, fitch forecasts prices to decline from an average $155 a tonne in 2021 to $65 a tonne by 2025 and $52 a tonne by 2030. Energy, iron ore stocks rally, but tech sinks asx.

The gap higher pulled prices above the 100 psychological level, which may step in to provide support on the next move lower. Ironsource stock has the potential to climb higher thanks to the company’s strong growth prospects. On average, they expect labrador iron ore royalty's stock price to reach $39.10 in the next year.

29, 2021 at 7:59 a.m. It eventually recovered to settle at $144.83. The global price of iron ore per ton has fallen below $100.

Iron ore is expected to trade at 93.01 usd/mt by the end of this quarter, according to trading economics global macro models and analysts expectations. A year ago, the median forecast for the closing level of the s&p 500 in. Irnt broke to the record high so far on thursday, with a gain of nearly 29% on the day, with the stock peaking at $47.50.

Min) , a mining and services company. Despite the sharp decline of chgg stock, its valuation remains elevated, given the firm’s growth outlook, its macro issues and the relatively low barriers to entry in. Among others, ironsource was chosen as one of the '20 hottest startups' in 2013 and was listed in the.

Friday was not so kind, with the stock retracing most of thursday's gains. She found the corporation’s predictions were frequently. This might allow the company to.

28, 2021 at 5:27 p.m. These 5 analysts have an average price target of $14.6 versus the current price of ironsource at $12.2575, implying upside. Western digital stock drops as outlook falls short of street view last updated:

Looking forward, we estimate it to trade at 83.27 in 12 months time. 22, 2021 price forecast | 2 weeks: Ellison gives iron ore price forecast chriss ellison is the executive chair of mineral resources ltd (asx:

The company said in a securities filing and during a presentation to investors at the new york stock exchange that its 2022 iron ore output is. Market intelligence forecasts 2022 iron ore prices at an average of $115/t, but there could be gyrations in the market. For 2021, so far, wall street’s predictions are off the mark by even more than that.

This suggests a possible upside of 37.8% from the stock's current price. Its core addressable market is expected to grow to $41 billion by 2025 from $17 billion in 2020. Below is a summary of how these 5 analysts rated ironsource over.

It currently stands at $94, which marks a decrease of 22%. Ironsource is a global software company backed by carmel ventures, a viola group affiliate, as well as cvc capital partners. The commonwealth bank has finally slashed its iron ore forecasts for 2021 and 2022 on the back of the steelmaking commodity’s 50% decline in value since reaching all time highs in may.

Major miners are largely not. The drop in clf stock recently has been driven by the fall in iron ore prices. Splunk forecast revenue of $2.51 billion to $2.56 billion for the end of fiscal 2022 ending in january, and total arr of about $3.9 billion in fiscal 2023 ending in jan.

The company focuses on developing technologies for app monetization and distribution, with its core products focused on the app economy.

Post a Comment for "Iron Source Stock Forecast"