Cumulative Preferred Stock Formula

Calculating cumulative dividends per share first, determine the preferred stock's annual dividend payment by multiplying the dividend. There are several simple formulas an investor in cumulative preferred stock should know.

We know the rate of dividend and also the par value of each share.

Cumulative preferred stock formula. The corporation determines whether or not to pay dividends. First, calculate the preferred stock's annual dividend payment by multiplying the dividend rate by. Par value is the face value for a share.

Compute the value of the common stock. The common stock will be valued as the present value of future dividends plus the present value of the future stock price after four years. For this reason, the cost of preferred stock formula mimics the perpetuity formula closely.

For example, abc company normally issues a $0.50 quarterly dividend to its preferred shareholders. The preferred stock is cumulative. The dividend rate and par value can be found on a preferred stock prospectus.

The weighted average number of shares of common stock outstanding for the year were 200,000. The formula for the present value of a preferred stock uses the perpetuity formula. If board of directors decides to pay a dividend of $1,200,000 in 2015, the cumulative preferred stockholders will be paid a total dividend of $1,000,000 ($5 per share for two years;

(do not round intermediate calculations and round your answer to 2 decimal places.) c. $500,000 for 2014 + $5,00,000 for 2015). Rp = d (dividend)/ p0 (price) for example:

In this case, we have the rate of dividend and par value is given, now we can calculate a preference dividend using the formula. Perpetual preferred stock price = fixed dividend ÷ dividend yield. If the company chooses not to pay dividends one year, the company considers those dividends to be in arrears.

Dividends on the cumulative preferred stock must be paid out before any dividends are paid to common shareholders. As previously stated, preferred stocks in most circumstances receive their dividends prior to any dividends paid to common stocks and the dividends tend to be fixed. The dividends will keep getting accrued till they are paid.

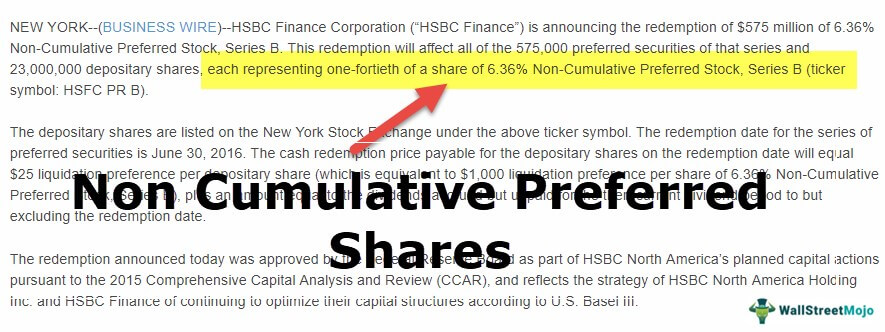

This means that shareholders do not have a claim on any of the dividends that were not paid out. The basic two things to calculate the dividend are given. Cumulative preferred stock is a type of preferred stock with a provision that stipulates that if any dividend payments have been missed in the past, the dividends owed must be paid out to.

Rp = d / p0. Rp = 3 / 25 = 12% Find out preferred dividends paid in each year and the amount, if any, available for distribution to common stockholders.

= $100 * 0.08 * 1000 = $8000. If net income for the 2015, 2016 and 2017 were $4.5 million, $8.5 million and $10 million. Cumulative preferred stock refers to shares of stock where the dividends accumulate each year unless the company pays them annually.

The remaining amount of $200,000 can then be distributed among common stockholders. Suppose cumulative preferred stock with a 10% dividend rate and a $1,000 par has. Dividend rate is the expected dividend payment expressed as a percentage on an annualized basis.

There are several simple formulas an investor in cumulative preferred stock should know. To calculate the dollar amount of a cumulative dividend, use the following formula: Earnings per share = net income/weighted average number of shares outstanding =$600,000/200,000 = $3.00 per share.

Noncumulative preferred stock allows the issuing company to skip dividends and cancel the company's obligation to eventually pay those dividends. With this, its value can be calculated using the perpetuity formula. If the current share price is $25, what is the cost of preferred stock?

What was the earnings per share ratio of abraham company? A company has preferred stock that has an annual dividend of $3. The discount rate used by the investment banker is 10 percent.

Preferred dividend formula = number of preferred stocks *par value * rate of dividend A nonperpetual preferred stock will have a stated buyback price and buyback date, usually 30. Preferred stocks usually pay dividends quarterly.

A perpetuity is a type of annuity that pays periodic payments infinitely. Preferred dividend formula = par value * rate of dividend * number of preferred stocks. A cumulative preferred stock is a type of preferred stock wherein the stockholders are entitled to receive cumulative dividends if any dividend payment is missed in past.

First, calculate the preferred stock's annual dividend payment by multiplying the dividend rate by its par. It means that every year, urusula will get $8000 as dividends. The cost of preferred stock formula:

The preferred stock dividends formula is par value x dividend rate x position + skipped dividends. Cumulative preferred stock not only pays current dividends, but it also must eventually pay out any suspended dividends. When a corporation is not able to pay dividends for a particular year, they get accrued.

Post a Comment for "Cumulative Preferred Stock Formula"